Filling in the time sheet. What problems can arise in the organization due to incorrect filling of the time sheet

In the process of studying the rules for recording working time, we will repeatedly refer to the following legal acts:

In 2015, a clarification was made to the Labor Code of the Russian Federation: if the seasonal or technological nature of production requires an increase in the accounting period, an industry (inter-sectoral) agreement and a collective agreement may provide for an increase in the accounting period for recording the working time of such workers, but not more than up to one year. So far, however, no such agreements have been developed, which means that enterprises cannot unilaterally waive the maximum length of the accounting period of 3 months.

Another difficult issue for the employer is the shortfall that has arisen following the results of the accounting period. This may be the result of illiterate scheduling of shifts. If an hourly wage system is established for such an employee, the level of his income decreases, which means that the employer is obliged to pay extra to the level of average earnings. The cause of unfinished shifts can also be force majeure, when external factors are to blame. In this case, the employer must retain for the employee 2/3 of the tariff rate or salary in proportion to the time worked (Article TK RF).

The opposite situation is processing at the employee. The difficulty lies in the fact that the personnel officer learns about processing only at the end of the accounting period when comparing the actual time worked and the norm of the production calendar. When calculating, remember about legally unworked days: vacation, time off, sick leave, etc. - they all reduce the rate. Next, determine if the employee worked during the accounting period on public holidays. These days have already been paid at least double the amount (Art. Labor Code of the Russian Federation), therefore, these hours (days) should not be paid additionally as overtime (paragraph 4 of the Clarifications, approved by the Decree of the Presidium of the All-Union Central Council of Trade Unions; Decision of the Armed Forces of the Russian Federation). If, after all calculations, the employee retains hours worked in excess of the norm, the employer pays them at an increased rate: the first two hours - at least one and a half times, the next - at least double (Article TK RF).

We emphasize that it is extremely important to comply with the rules for recording working hours. This affects the calculation of wages and additional payments for work in conditions that deviate from normal. Correctly filling out the time sheet allows you to correctly pay the employee for his work and, importantly, take into account all the time actually worked in the length of service.

The time sheet is defined by the Decree of the State Statistics Committee No. 1 dated 01/05/2004 (the time sheet is mandatory, but the law does not provide for a strict framework on the form of the document). A specialized form is established, which is filled out by personnel services or accounting. This document is necessary in order to clearly control and take into account the time worked by employees. For accountants, this form becomes the basis for monitoring the legality of all types of accruals. This timesheet allows employees of the personnel department to track the attendance of employees at assigned jobs according to a previously established schedule, which includes working days and weekends. The time sheet also helps to impose penalties in case an employee systematically violates this schedule.

The time sheet allows you to control the lateness, attendance and absence of employees, that is, it is the basis for monitoring compliance with the work schedule. With the help of the time sheet, it is possible to obtain official information on the issue of hours worked for each employee. Accordingly, this document has an important compilation for special statistical reporting and the formation of wages.

In fact, the time sheet is a well-developed form of the document, which is presented in the form of a table. Data on employees are entered into the table, as well as all data related to his working hours, appearance and absence, the reasons for the absence are indicated, and after that, total those days, as well as the hours that were worked by the employee during a well-defined period of time. When filling out the document, code designations for the reasons for the absence from work of specific employees are used. The legislator determines the possibility of developing his own form of this document, on the basis of which the accounting of hours worked should be carried out.

The form of the T-13 time sheet is not mandatory, since in 2013 certain adjustments were made to legislative acts who determined that the employer may refuse to use this document. But, in part 4 of Art. 91 of the Labor Code of the Russian Federation states that all employers are obliged to draw up a document taking into account the working hours of all employees. That is, it is possible to create your own document, the filling of which will be convenient for the employees of your enterprise. Traditionally, enterprises use the T-13 form.

Who leads the T-13 in the organization?

The legislation does not establish who exactly should maintain the time sheet. But, the rules for maintaining primary documentation determine the following:

- The time sheet must be kept mandatory, and the maintenance is carried out by an authorized person;

- The head of a separate unit is obliged to sign the document, it is also signed by a specialist in the personnel department;

- Based on the time sheet, the accrual of remuneration is formed, respectively, the document is sent to the accounting department.

The authorized person who fills in and maintains the time sheet is appointed by the management, with a description in the employment agreement of all obligations in this area. A document (order) is also created, in which the position of the employee is listed, and his individual data. In large enterprises, an employee is selected in each department, who carries out the process of keeping records of the actual time worked by all employees of the organization. Within a month, the employee fills out the form, after which he submits it to the head of the department for study and signature. The head, in turn, passes the document to the personnel officer. There is a reconciliation of data, others are filled Required documents, and the time sheet is transferred to the accounting department, which allows you to correctly calculate wages. In small organizations, as a rule, filling out the time sheet is carried out by an employee of the personnel department.

The procedure for maintaining form T-13

Each employer can independently supervise and control the procedure for maintaining a document. It is best to work out a manual or instruction that will provide the employee with clear instructions on all issues of compiling primary type documentation. And it will also become the basis for choosing a well-defined form of accounting for actual time worked (the law defines two main forms of the document - T-12 and T-13, the legislator also allows the employer to develop its own form of document), etc. In the instructions or the manual for compiling the time accounting form , which the employee actually worked out, it is best to indicate the following main points:

- If the enterprise is large, then indicate that the time sheet is compiled by department. That is, in each division, a separate employee is appointed who will keep records of the time worked by the employees of the department;

- A description of the structure for selecting a responsible employee is being worked out, who will carry out the process of keeping records of the attendance of all employees of the organization;

- Make a description of all additional codes that can be used to determine the absence or exit of the employee to work (most often, the codes indicate the reason for absenteeism);

- Determine the complete procedure for filling out the accounting form: indicate how the facts of presence / absence, lateness, reasons for absenteeism, etc. are reflected;

- Determine the order that will help reflect exit/absence data in non-standard situations.

Ways to fill out the T-13 form, the main codes for filling out the time sheet

Formed various options registration of the form for recording actual hours worked. This can be a reflection of all data for each day, and data that relates to the presence or absence of employees must be indicated. There is also a second option for filling out the document, which involves indicating only deviations from the norm. That is, in fact, a description of absenteeism and lateness is formed.

Two variants of codes are defined, through which information is reflected in the report card. Recall that the time sheet is a specialized table in which it is simply impossible to indicate all the data in writing. Therefore, there are generally accepted codes, the use of which allows you to quickly and easily complete the time sheet.

- Employee turnout workplace on a well-defined day it will be reflected by the letter "I", or by the digital code 01;

- The standard vacation option, which is determined by the organization's schedule, and is considered annual paid, is noted in the "OT" report card, or with a digital value - 09;

- If we are talking about leave that is provided to women during pregnancy and childbirth, then the letter “P” is used, or the number is 14;

- If the employee receives leave that is associated with caring for a young child, then “OJ” or 15 is indicated;

- Vacation, without providing payment, that is, at its own expense, is marked "TO" or 16;

- If the employee is sent on a business trip, then the letter “K” is indicated, and in the digital value it is marked as 06;

- If an absence from work is formed, taking into account the fact that the circumstances of this event are not yet known, “НН” is indicated, in the digital value 30;

- The sick leave in the document is reflected as "B" or 19.

The document must contain information about the employer. In the header, you will need to enter the name of the organization, information about the OKPO code. In addition, the name of the unit is indicated if we are talking about a time sheet that is filled out for a clearly defined department of the enterprise. Information is indicated in the form of a date and a document number, that is, based on this information, it is possible to determine the exact period of preparation of the document.

The following is information about the employee. Each employee is assigned a specific personnel number. This number is subsequently used to compile all other internal documents in the enterprise. Information about the position, individual data of the employee (full name) is required. At certain enterprises, this column also indicates information on the basis of which the employee was hired by the enterprise, that is, the data of the order for admission to the position are indicated.

The timesheet contains all the data on the working hours of all employees (for each separately). That is, in the column for each employee, a daily description of all data on attendance, absence, vacation, day off, etc. is formed. All data is indicated in an alphabetic or numeric value.

The document also reflects the total number of days and hours worked at the enterprise, taking into account all the data on working hours that were indicated in the time sheet. In the second and fourth lines, which are located under the lines indicating the presence at work, the need to indicate the actual hours worked is determined. These lines may not be in the document, so their completion is not considered mandatory.

The document has a column in which you can enter all the data on absenteeism. That is, in fact, it is here that information is reflected that relates to the reasons that became the basis for the absence of an employee in his place on one or another day. An indication of the hours that the employee was absent from the enterprise is entered into the document. It also indicates how many days the employee was absent for one reason or another (for example, the employee did not work for ten days, 4 days due to a business trip, and 6 days due to vacation at his own expense).

After drawing up the T-13 form by the responsible officer, the process of signing the document is necessarily carried out, which actually makes it legally significant, and then makes it a kind of basis for accruing funds in the form of wages. The document is signed by the responsible person, the head of the department, as well as an employee of the personnel service.

Leave must be indicated in the time sheet. In this case, it is determined what type of vacation is granted, and the dates when the person is on this vacation are indicated. There are various letter designations that are included in the document. The standard option is the next vacation, “FROM” is marked, but if we are talking about additional vacation, which will be paid by the employer, then “OD” is affixed. If the vacation is not paid, then "TO" is indicated. Often, employees carry out parallel distance learning, and for the period of study - sessions, paid leave is provided, which is reflected in the documents "U". There are situations when an employee attends training, but remains to perform his direct duties at a company or enterprise, in this case, it is provided to use a shortened working day, and in the report card this fact is reflected in the form of the letter value "UV". Leave, which is associated with childbirth, as well as pregnancy, is indicated in the form of the value "P", for the care of the child "OJ". Also, leave in certain cases is provided without payment, and in this case, the letter value “OZ” is formed.

How is absence from work marked?

A specific code is also provided to indicate temporary absence from work. All data in the report card is indicated in alphabetical form, which allows accounting employees to clearly determine all the nuances of calculating wages, and necessarily vacation payments and sick leave payments. If a person did not go to work, but provided information that he was sick, then temporary disability under this condition is indicated by the letter "B". There are situations when there is a removal from the performance of professional duties. The report card is marked "NB". If the enterprise does not pay wages, then the employee has the right not to visit his work, and not to fulfill the obligations established by the employment agreement, in accordance with the stipulated norms of the law. Such a fact in the report card is reflected in the letters "NZ", which actually indicates the suspension of work, due to the employer's failure to fulfill all his obligations to pay for the work performed. If the suspension from the performance of professional duties is carried out with the accrual of payment from the employer, then in this case the value “NO” is indicated, which allows accountants to accrue the amount of payment labor activity, taking into account the fact that the employee was not present during certain working days.

How is idle time marked in the report card?

It should certainly be noted that there is such a concept in enterprises as simple. That is, in fact, the employee is present at his workplace, however, certain work processes are not carried out. In this case, data is initially entered in the employment agreement that determines the structure for calculating wages in the event that the downtime is carried out through the fault of the employee, employer, or for reasons that do not depend on the employee or employer. The timesheet also contains data that relates to downtime. If it is formed through the fault of the employee, “VP” is indicated, if the fault of the employer is traced, “BP” is indicated, if the downtime is formed by other factors, then “NP” is indicated.

In accordance with the Labor Code of the Russian Federation, employees must receive days off. However, in certain cases, holidays do not fall on the employee's holiday, in other words, employees have to work on weekends, but at a higher rate. The law establishes that an employee who works on holidays and weekends receives a higher pay. If absenteeism is formed due to a day off, “B” is indicated in the report card, if the day off is incomplete, “HB” is indicated. Also, the employer can provide an additional day off, which will be indicated in the "OB" report card, if it is paid. If the additional day off is not paid, it is reflected in the document with the letters "НВ".

Non-standard situations when filling out the time sheet

There are non-standard situations when specialists do not know how to correctly mark certain values in the report card. For example, consider a situation where an employee falls ill while on annual leave. The legislation establishes that in the case when a worker falls ill on vacation, a sick leave is formed, and the vacation is extended for a clearly established period, which is determined by the sick leave, if any. In the report card, “B” is affixed instead of “OT”. If, after the vacation, the employee did not go to work, then “HN” is put, that is, it is indicated that the absence was made for an unknown reason. After documents are provided that determine the existence of a valid reason for non-attendance, for example, they provide a sick leave, “B” is affixed instead of “HN” in the report card.

Where can I find the codes for completing Form T-13?

When making the T-13 form, it is the letter values that are used. Since to indicate everything in words is simply unrealistic. Most often, already developed additions are used, in the form of codes that are provided in Appendix 1 to the official order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] However, the manager can develop their own code values. In this case, a special addition is made to the instructions for drawing up the time sheet, in the form of a fairly simple table.

What are the differences between the T-13 and T-12 uniforms?

As you already know, there are two well-developed forms of the document, and the legislator does not limit the employer in choosing a form that can be filled out in the process of recording working hours. These forms are almost identical, but there are still some differences. Practice shows that modern employers most often prefer the T-13 form, as it is easier to compile.

Form differences:

- Form T-12 also contains columns for the days of the month that refer to a well-defined employee, but these lines are located in a horizontal direction. As for the T-13 form, there they are divided into two parts and are parallel. That is, in fact, in the T-13 form, you indicate all the data on visiting work in the first lines, the second lines indicate the amount of total working time in hours. It's more convenient;

- It should also be said that for each employee in the T-13 uniform, four lines are allocated for the reasons for absence from the workplace, which allows you to control all the nuances of absenteeism and the presence good reasons. In the T-12 form, such data is also reflected, but only two lines are allocated for them;

- There is a final part in the T-13 form, which is not reflected in the T-12 form. In fact, the first option reflects not only information about the appearances and absences of each employee, but also the codes of types of payment, which allows accountants to quickly navigate the issue of calculating payment for the work performed.

AT specified form there is a special department that reflects all the data on the accrual of funds, as payment for activities, taking into account hours worked, vacation pay, absenteeism, etc. That is, in fact, by indicating all the data on accounting for total working time, the possibility of correct and sufficient fast accrual Money in accounting. The document must indicate the codes of the cash payment. These codes are indicated exclusively in numerical value:

- 2000 - accrued wage provided in the form of wages;

- 2012 - the amount of vacation pay, which is determined by the schedule of the next vacation for each employee.

This section also necessarily indicates the corresponding account, that is, a specialized account from which all costs for paying for activities are debited.

It also indicates the number of days or hours worked, taking into account a certain type of remuneration. For example, standard working hours (days of attendance) are entered, information on travel and vacation pay is entered. It is mandatory to indicate the code of the type of payment, and the number of the account from which the process of crediting the payment for certain working hours of the employee will be carried out.

conclusions

The time sheet is a mandatory document that must be filled out at any enterprise. After all, it is on the basis of this document that the following processes are carried out:

- Monitoring the work of all specialists at the enterprise;

- Control of timely visits to working hours;

- Control of hours worked, taking into account the formation of the possibility of correct payroll.

In other words, the time sheet is a document, using which the manager receives all the necessary data on the responsibility of employees and their fulfillment of the terms of the labor agreement, as well as the staffing table. And on the basis of this document, accountants get the opportunity to correctly calculate wages in order to follow all the norms of labor legislation.

The legislator does not establish strict requirements for compiling a form of proper accounting of working hours, but determines the need for this accounting. There are two developed forms, all the nuances of which we discussed with you above, in fact, you just have to study this information in order to learn how to draw up a document yourself. It should also be noted that there are specialized programs that allow you to carry out the process of recording working hours in a simplified mode, to study the nuances and features of such programs, we suggest you watch this video.

Labor law obliges employers to keep records of the hours worked by employees. Organizations must record hours worked regardless of their legal status and individual entrepreneurs. Especially for this, the State Statistics Committee developed and approved the forms of the Timesheet N T-12 and N T-13.

Here are instructions for filling out, which will help to correctly reflect the data and use the time sheet rationally.

Why do you need a time sheet

The time sheet, approved by the Decree of the State Statistics Committee of 01/05/2004 No. 1, helps the personnel service and accounting department of the enterprise:

- take into account the time worked or not worked by an employee;

- monitor compliance with the working time schedule (attendance, non-attendance, lateness);

- have official information about the time worked by each employee for calculating salaries or compiling statistical reports.

He will help the accountant confirm the legitimacy of accruing or not accruing wages and compensations to each employee. Personnel officer - to track the turnout and, if necessary, justify the penalty imposed on the employee.

The time sheet refers to the forms of documents that are issued to the employee upon dismissal along with the work book at his request (Article 84.1 of the Tax Code of the Russian Federation).

It should be noted that the unified forms of timesheets N T-12 and N T-13 from January 1, 2013 are not mandatory for use. However, employers are required to keep records (part 4 of article 91 of the Labor Code of the Russian Federation). Organizations and individual entrepreneurs can use other ways to control the time spent by employees in the workplace. But in fact, the format of the form developed by the State Statistics Committee is quite convenient and continues to be used everywhere.

Who keeps the timesheet in the organization

According to the Guidelines for the application and filling out forms of primary accounting documents:

- the time sheet for 2019 is compiled and maintained by an authorized person;

- the document is signed by the head of the department and the employee of the personnel service;

- after which it is transferred to the accounting department.

As we can see, the rules do not establish the position of the employee who maintains the timesheet. Management has the right to appoint anyone to perform this task. To do this, an order is issued indicating the position and name of the responsible person. If the order to appoint such an employee is not issued, then the obligation to keep records should be spelled out in employment contract. Otherwise, it is unlawful to require an employee to keep records. In large organizations, each department has a designated employee. He fills out the form within a month, gives it to the head of the department for signature, who, in turn, after checking the data, passes the form to the personnel officer. An employee of the personnel department checks the information, fills out the documents necessary for his work on its basis, signs the time sheet and transfers it to the accountant.

In small firms, such a long chain is not observed - the time sheet leads personnel worker, and then immediately transfers to the accounting department.

What is the difference between forms N T-12 and N T-13 of the Timesheet

The two approved forms differ in topics, one of them (T-13) is used in institutions and firms where a special turnstile is installed - an automatic system that controls the attendance of employees. And the T-12 form is considered universal and contains, in addition, an additional Section 2. It can reflect settlements with employees for wages. But if the company keeps accounts with personnel as a separate type of accounting, section 2 simply remains empty.

Filling out the time sheet

There are two ways to complete the spreadsheet:

- continuous filling - every day all appearances and absences are noted;

- filling in by deviations - only lateness, absenteeism are noted.

For example, we give instructions for filling out the T-13 form using the continuous filling method.

Step 1 - the name of the organization and structural unit

At the top, enter the name of the company (full name of IP) and the name of the structural unit. It can be a sales department, a marketing department, Production Department etc.

Step 2 - OKPO code

OKPO - all-Russian classifier enterprises and organizations. Contained in the databases of Rosstat, consists of:

- 8 digits for legal entities;

- 10 digits for IP.

Step 3 - document number and date of compilation

- The number of the document is assigned in order.

- The compilation date is usually the last day of the reporting month.

Step 4 - reporting period

The time sheet is handed over for a month - the period from the first to the last day of August in our case.

Step 5 - Employee Information

A separate line is filled in for each employee of the department.

- Ordinal number in the table.

- Surname and position of the employee.

- A personnel number is assigned to each employee and is used in all internal accounting documents. It is retained by the employee for the entire time of work in the organization and is not transferred to another person for several more years after the dismissal.

Step 6 - Attendance and Hours Details

Abbreviated symbols are used to fill in information about attendances and absences of employees. You will find a list of them at the end of the article in a separate paragraph. In our example, for the worker Petrov A.A. 4 abbreviations used:

- I - turnout (in the case of turnout, the number of hours worked is recorded in the bottom cell);

- On a weekend;

- K - business trip;

- OT - vacation.

Step 7 - the total number of days and hours for the month

- In the 5th column indicate the number of days and hours worked for every half month.

- In the 6th column - the total number of days and hours for the month.

Step 8 - Payroll Information

The payment type code defines a specific type of cash payment, encrypted in numbers. See the full list of codes at the end of the article. The example uses:

- 2000 - salary (wages);

- 2012 - vacation.

- Corresponding account - an account from which the costs for the specified type of remuneration are written off. In our case, the account for writing off wages, travel payments and vacation pay is the same.

- Column 9 indicates the number of days or hours worked for each type of wage. In our case, the days of attendance and business trips are entered in the upper cell, and the days of being on vacation are in the lower cell.

If one type of remuneration (salary) is applicable to all employees during the month, then the type of payment code and account number are written on top, columns 7 and 8 are left blank, indicating only the days worked or hours worked in column 9. Like this:

Step 9 - details of the reasons and time of no-show

Columns 10-12 contain the code for the reason for the absence and the number of hours of absence. In our example, the employee was absent for 13 days:

- 3 days - in connection with a business trip;

- I was on vacation for 10 days.

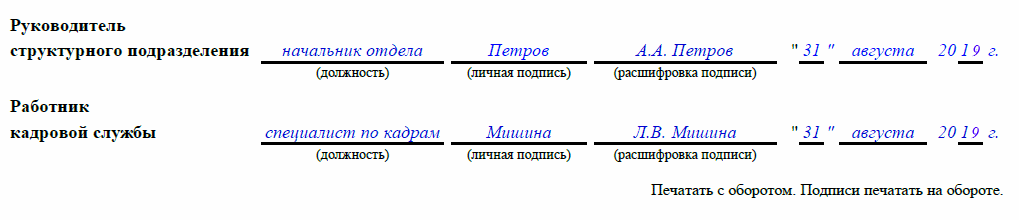

Step 10 - signatures of responsible persons

The time sheet is signed at the end of the month:

- the officer responsible for the maintenance;

- department head;

- personnel worker.

How to mark vacation in the time sheet

Before marking a vacation in the time sheet, it is important to know the following points:

- what type of vacation to put down;

- vacation period - from what date to what date the employee rests;

- what method the time sheet is filled in - solid or only deviations are recorded.

Different types of leave are indicated in the report card by the following abbreviations:

|

another paid vacation |

|

|

additional paid |

|

|

administrative (without saving salary) |

|

|

training with saving salary |

|

|

on-the-job training (shortened day) |

|

|

training without saving salary |

|

|

for pregnancy and childbirth |

|

|

caring for a child up to 3 years |

|

|

without saving the RFP in cases provided for by law |

|

|

additional without saving RFP |

When using both methods of filling out the time sheet, the leave symbol is affixed for each day the employee is absent. It’s just that when using the continuous method, the remaining days are filled with turnouts (conditional code “I”), and when using the method of accounting for deviations, they remain empty.

Other designations and codes in the table

We give the letter designations used in the time sheet in the form of tables.

Workplace presence:

Absence from work:

|

temporary disability (sick leave) with payment of benefits |

|

|

temporary incapacity for work without payment of benefits |

|

|

reduced working hours in cases provided for by law |

|

|

forced absenteeism during illegal suspension (dismissal) |

|

|

failure to appear in connection with the performance of state (public) duties |

|

|

truancy without good reason |

|

|

part-time work |

|

|

weekends and public holidays |

|

|

additional paid holiday |

|

|

additional unpaid holiday |

|

|

strike |

|

|

unexplained reason for absence |

|

|

downtime due to the fault of the employer |

|

|

downtime for reasons beyond anyone's control |

|

|

downtime due to employee |

|

|

suspension from work (paid) |

|

|

suspension without pay |

|

|

suspension of work with a delay in the RFP |

We give only main digital codes of types of remuneration(The full list is in the Order of the Federal Tax Service of Russia of October 13, 2006 N SAE-3-04 /):

Completed timesheet template

The time sheet is maintained by any company, as it reflects important information about all employees, allowing you to control labor discipline. The time sheet contains information about the amount of time worked by each employee. Based on them, the management decides who to encourage, who to punish with bonus deductions, and the accountant calculates the salary.

The mode of working time is the distribution of this time within the range of any calendar period. It strictly regulates the duration working week, which happens as follows: five working days / two days off; six working days / one day off; sliding (replaceable) schedule; as well as irregular working hours, start and end hours, consecutive work/non-work days, and more.

Shift work- this is a type of employment in which the production process does not fit into the permitted duration of the working day. In such cases, shifts are introduced - two or more, depending on the need.The special mode is irregular working hours. It provides for the possibility of involving the superiors of the employee to perform his duties outside the established working hours.

Another mode is flexible schedule. Here working time determined by the consent of the parties. Management controls the working hours of the staff.

In practice, three types of accounting are used:

- daily— the duration of daily work complies with the established legislation. The beginning, end and duration of the working day do not change;

- weekly– daily hours of operation may vary, but weekly norms will be strictly observed;

- summarized- similar to the previous one, only the reporting period is a month, a quarter, etc.

Rules for maintaining a time sheet or how to draw up a time sheet correctly

Time sheet: how to fill it out? Below we will answer this question in detail. The time sheet is maintained both in electronic form and in paper form, the latter form being obligatory. Filling in data only on the computer is not allowed.

You can download the time sheet, its form, sample or form, for free on the Internet. A sample of filling out a time sheet, as well as a completed time sheet, can also be viewed in programs such as Consultant Plus and Guarantor.

The opening of the time sheet occurs on the first day of each month. It is usually provided to the accounting department twice: before the advance payment, and then before the payroll.

All employees of the organization are assigned a personnel number used in documents on labor control and payment.

Changes due to the admission of new or dismissal of old employees are made only on the basis of official orders from management.

Temporary workers, interns, who are paid, are also included in the time sheet. But! Those working under a civil law contract are not time-sheeted, and part-time workers are provided with a separate personnel number.

It is necessary to fill out the time sheet every day for a whole month, and on the last working day, a summary is made for each employee: how many absences there were and how many hours worked. To fill out the time sheet, you need the T-12 or T-13 form; in terms of the availability of details, they are almost identical.

Consider step by step instructions on the preparation and execution of a time sheet based on these forms.

- Above you need to enter the name of the company. It must fully comply with the name indicated in the constituent documents.

- Next, the sections “Date of compilation” are filled in (often this is the last day of the reporting month) and “Document number”.

- The "Reporting period" cell contains the range from the 1st to the last day of the month.

- The first column of the first section ("Accounting for working hours") contains the serial numbers of the personnel.

- Columns 2 and 3 are filled out based on personal cards (form No. T-2)

- The 4th and 6th columns are the cost code and the daily hours worked.

- The 5th and 7th columns are the intermediate results for the first half of the month and the second, respectively. The top cell contains days worked, the bottom cell contains hours worked.

- Columns 8 to 17 are filled in at the end of the month. The total of days worked does not include weekends, business trips, absenteeism of employees, i.e. those days when a person was not actually at the workplace.

- The 8th column is the sum of the top cells from the fifth and seventh columns.

- 9th column - the sum of the lower cells of the fifth and seventh columns.

- The 14th and 16th columns are the number of hours and days.

- The 15th column contains the code for the reason for the absence.

- 17th column - the total number of days off per month.

The second section of the timesheet is maintained by accounting.

Time sheet: symbols, codes and abbreviations

In total, 36 codes are provided in the timesheet of employees. Each indicator has an alphabetic and numeric designation. Below is a transcript of the time sheet:

| Index | Letter designation | Numerical designation |

| Duration of work: - day time; - night time; - weekends/holidays; - overtime work; shift method. | YANRVSVM | 102 030 405 |

| Business trip | To | 06 |

| Advanced training: - there is a break from work; - there is a break from work with a trip to another area. | PCPM | 0708 |

| Leave: - basic paid; - additional paid; - additional paid in connection with education; - reduction of working hours in connection with education while maintaining a partial salary; - additional unpaid in connection with education; - for pregnancy and childbirth; - for child care up to his 3 years of age; - unpaid, provided with the permission of the management; - unpaid, provided for by law; - annual additional without pay. | OTODUUVUROZHDOOZDB | 9 101 112 131 415 161 856 |

| Temporary incapacity for work: - with the appointment of benefits under the law; - without the appointment of benefits. | BT | 1920 |

| Reduction of working hours provided by law | Champions League | 21 |

| Forced absenteeism (due to dismissal, transfer to another job) | PV | 22 |

| Absence due to public or government duties | G | 23 |

| Walking for no good reason | ETC | 24 |

| Part-time work at the discretion of the manager | NS | 25 |

| Weekends and holidays | AT | 26 |

| Additional paid holidays | OV | 27 |

| Additional unpaid holidays | HB | 28 |

| Legal strike | ZB | 29 |

| Absences for unknown reasons | HH | 30 |

| Downtime: - due to the fault of the employer; - for reasons beyond the control of either the employee or the employer; - due to the fault of the employee | RNSAP | 313 233 |

| Suspension from work provided for by law: - with pay; - without pay | NONB | 3435 |

| Suspension of work due to delayed salary | NZ | 36 |

Programs for maintaining a time sheet

To fill out the time sheet on a computer, there are many programs that can be ordered on the Internet. Thanks to them, it will not be difficult to create an electronic time sheet. Consider the most popular among users.

All operations, functions and features are simplified as much as possible and are designed to reduce such a laborious and time-consuming process as the calculation of working hours.

The program has an intuitive interface that allows you to create shift schedules. To learn how to work on it, no courses are required. The timesheet program is written in Excel. It has the ability to record:

- working hours;

- night working hours;

- daily working hours;

- employee's time of incapacity for work;

- hours worked during weekends and holidays;

- absenteeism;

- defects or processing.

Program "Time sheet"

This program is also designed to take into account working hours. It can be ordered online for 700-800 rubles. To get acquainted with the principle of its work, you can download a trial version of the time sheet for free. If it has everything you need, then you can buy it. This will require registration and payment, after which a registration key will come that removes all restrictions.

Write a question in the form below: